Have you decided to open a Solo 401(k) but are a bit confused about whether you agreed on the right thing?

You will be able to put your confusion to rest if you acquaint yourself with the pros of a Solo 401(k). And those will also dictate why you should open one.

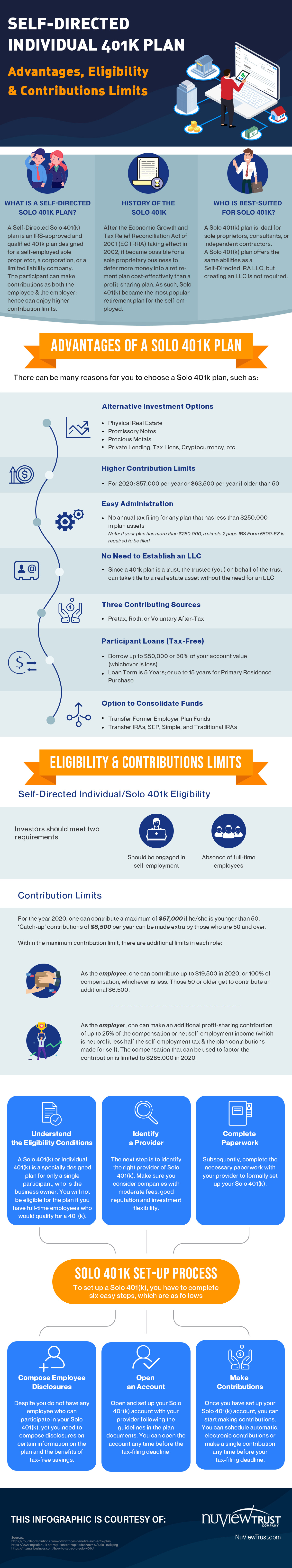

Before you go through the pros, it makes sense for you to walk through the process of opening the account.

Once you have chosen a Solo 401(k) provider and adopted the plan agreement for your Solo 401(k), you can now set up your Solo 401(k) account with the provider.

You can open the account any time before your tax-filing deadline and follow the guidelines in your plan documents.

Pros of a Solo 401(k)

You should go through the pros of a Solo 401(k) to get to know what benefits the plan has to offer.

The following are some of the essential advantages of a Solo 401(k):

- No need to pay a custodian

- Make nine times higher contributions than with a traditional IRA

- Can make investments without having to wait for someone else

- Can invest in real estate, private companies, precious metals, and anything else

- Can borrow up to $50,000 from your Solo 401(k) plan for any purpose

- Complete control of your retirement funds

- Can diversify your retirement portfolio

- Serve as trustee of your Solo 401k plan

- Can make Roth contributions to your Solo 401(k) plan

- Can grow your retirement funds tax-free

The bottom line is that a Solo 401(k) plan fills the void arising out of the absence of an employer-sponsored retirement plan for the self-employed. A Solo 401(k) plan offers the same features as a Self-Directed IRA LLC, but creating an LLC is not required.

It will help if you brush up your knowledge of a Solo 401(k) plan by referring to the infographic in this post.